What is my business Worth?

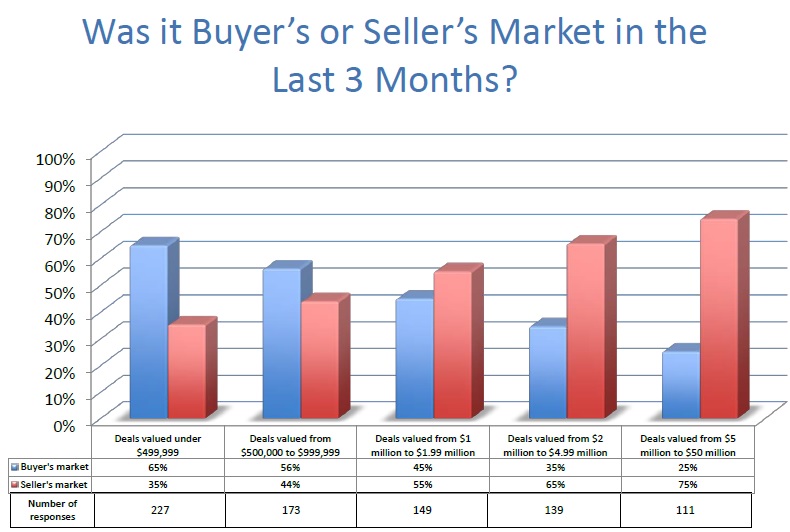

Getting accurate information on Private businesses sold can be difficult. Below I am sharing information on businesses sold during the 2nd Quarter of 2016. This information comes from a survey that includes over 375 Business Broker and Business Professionals involved with buying and selling businesses. I am a 10 year Business Broker working with Business Sellers and Business Buyers in South Carolina Florida and Southeast USA.

If you are considering the sale of your business, planning or preparing an exit strategy from your business or considering buying a business the below information provides valuable insight.

There are many valuable points to be gleaned from the below but a very important underlying point is that businesses are different. You can see the information surrounding what a business sells for, why a business owner sells, who the business buyers are, where a buyer comes from , and why a business buyer buys a business. The size of the business affects all these aspects are very dependent on the size of a business.

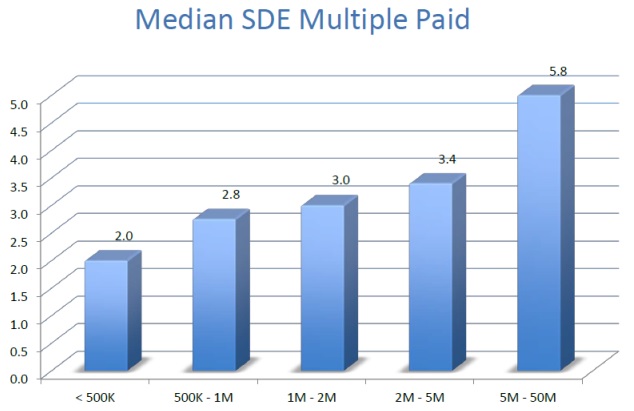

A $1M business may sell for a multiple of cash flow of 3,4,5 x- but this doesn’t necessarily mean that a $400k business would sell for a similar multiple.

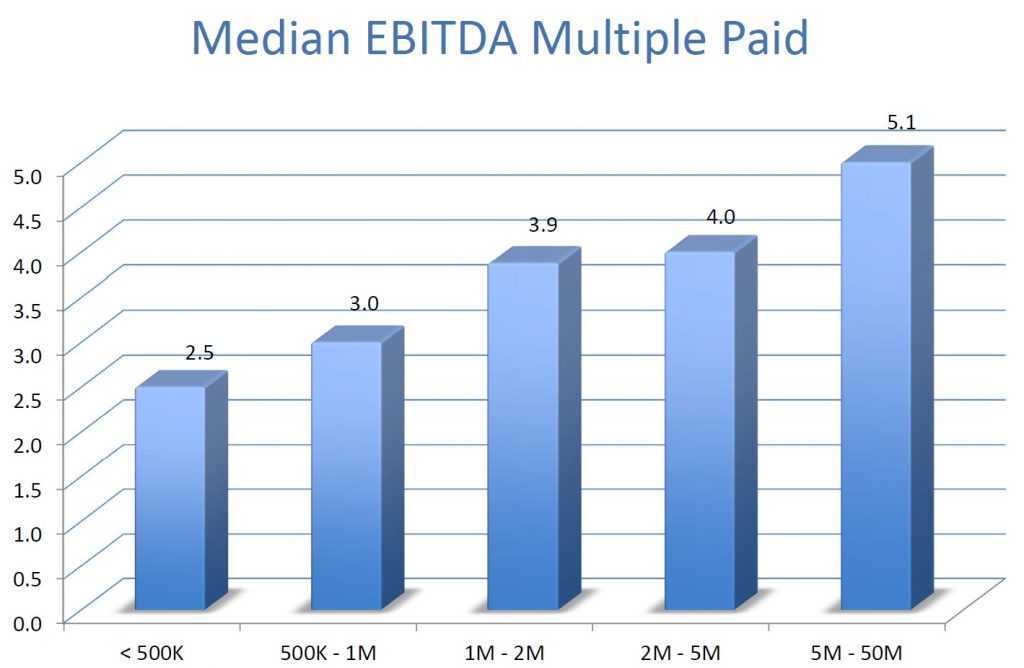

What is My business Worth? Below chart shows what businesses recently sold for. Please note Buyers Paid a higher multiple of EBITDA (Earning before Interest Taxes Depreciation Amortization ) for larger businesses. A business of say $200K of Ebitda may get 2.5 x that Ebitda, whereas a business with $500k of ebitda may get 4 x ebitda. Cash flow, adjusted cash flow, ebitda, owner benefit, seller discretionary earnings or other related measurement of earnings are a significant factor when determining business value.

South Carolina Business Broker

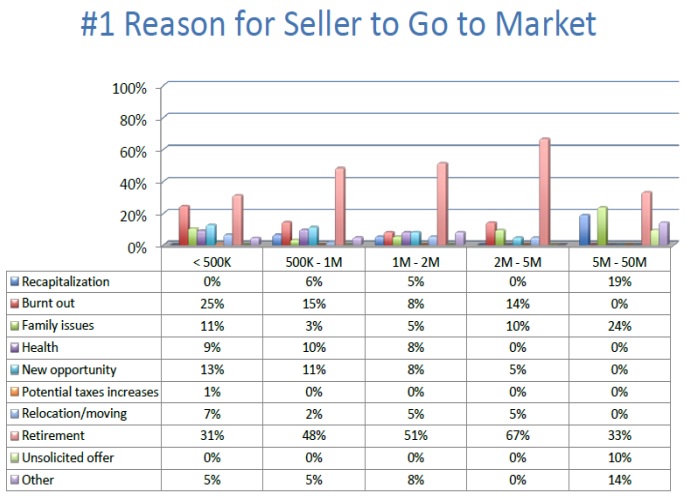

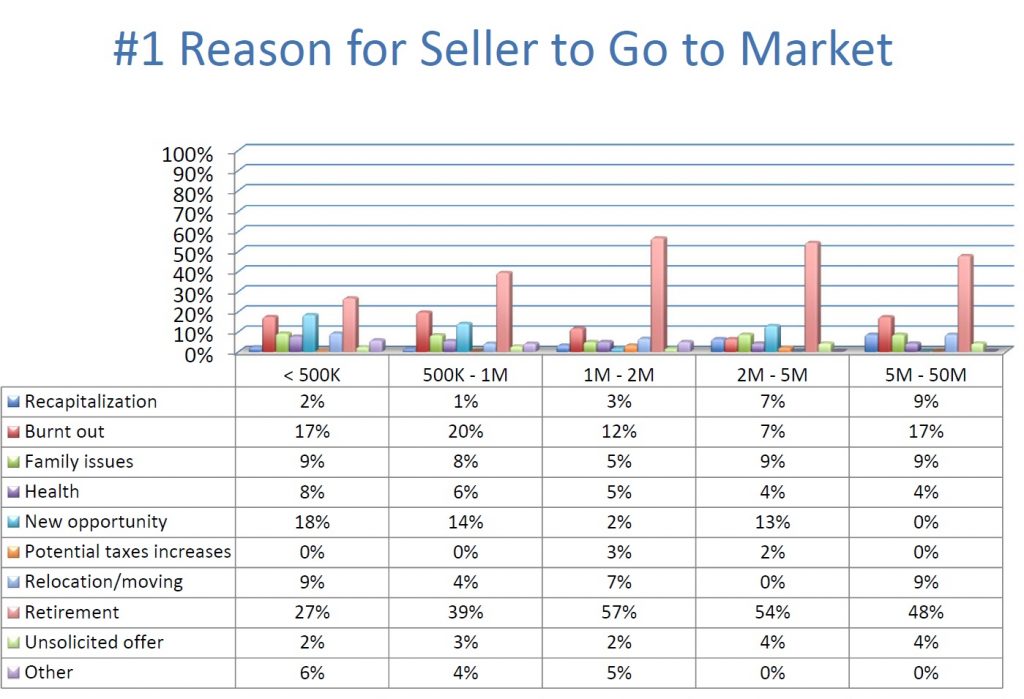

Why did Business Owners Sell their Business. Are you a South Carolina or Florida Business Owner considering the sale of your business?

South Carolina Business Broker

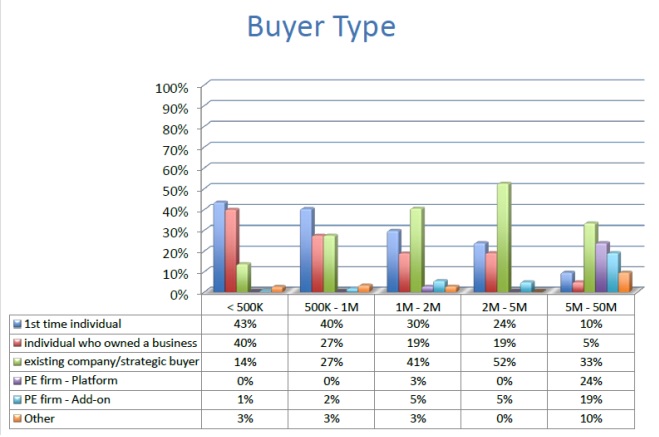

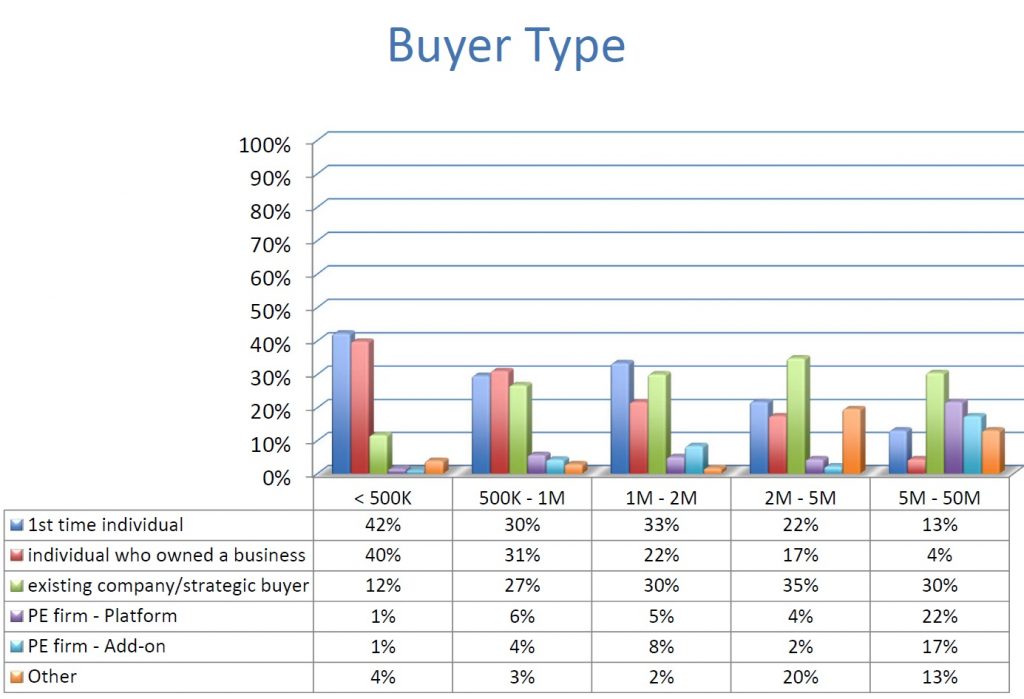

Who were the Business Buyers during the 2nd Quarter of 2016?

South Carolina Business Broker

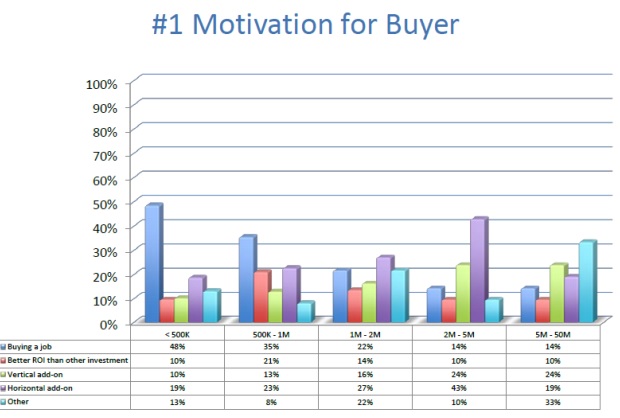

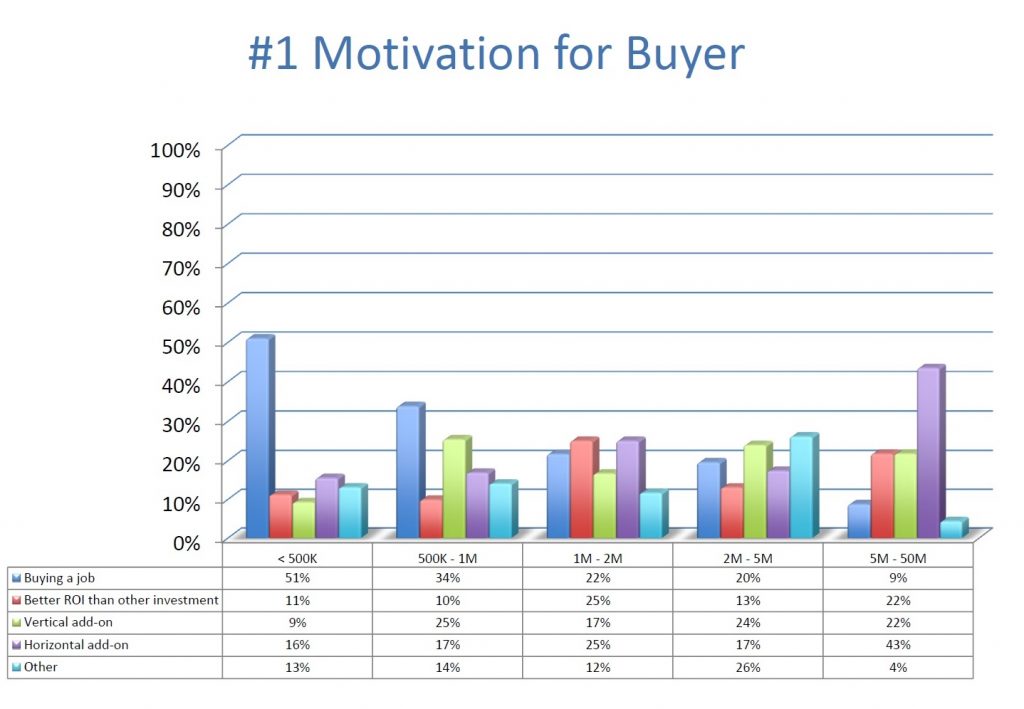

Why did Business Buyers Buy a Business in South Carolina Florida and the rest of the US?

South Carolina Business Broker

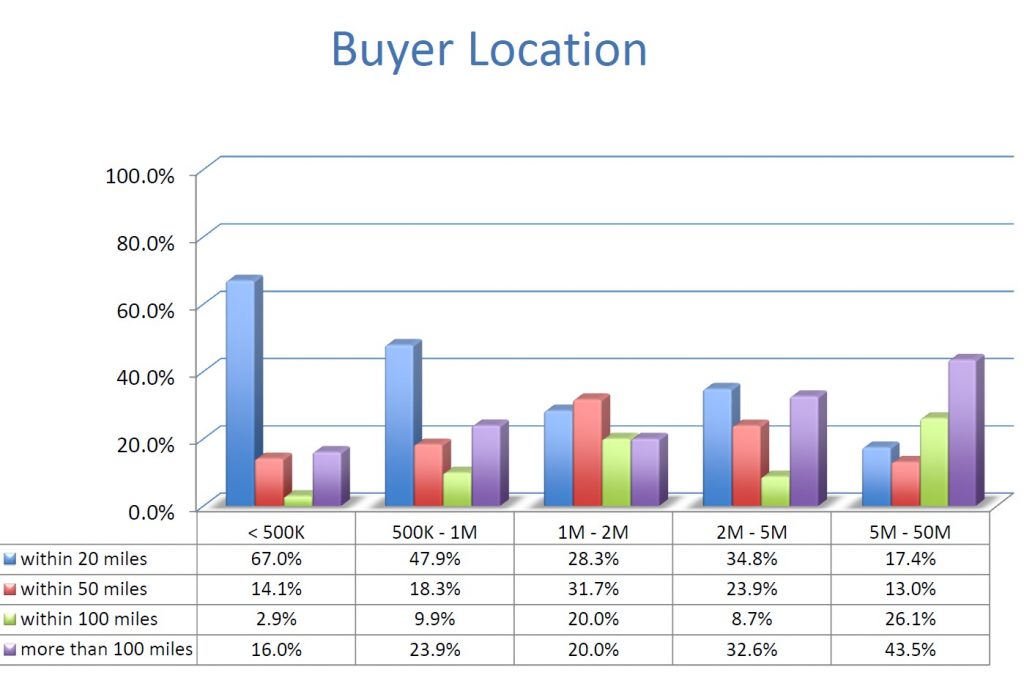

Where did the Business Buyers come from? Usually they come from somewhere else. For me as a South Carolina Business Broker and Florida Business Broker the last 10 business I sold the buyers on all of them came from distances of 200-1000 miles away.

South Carolina Business Broker

Scott Messinger is a Business Broker Based in the Upstate South Carolina with main offices in Florida and working with South Carolina Business Sellers, Florida Business Sellers, and business buyers and Sellers throughout USA.

For more information Please contact me at (864) 210-8226 or (239) 770-2421 or Scott@GatewayBusinessAdvisors.com