Businesses Selling at a Record High

Number of Businesses Selling at 10 Year High

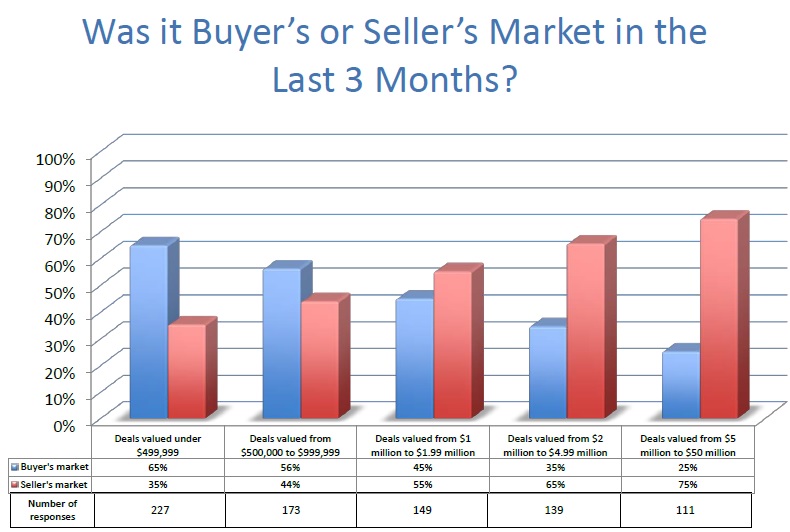

Businesses are selling at Highest Rate in Years . The below information and charts are based upon Market Information gathered by a survey of over 275 Professional Business Brokers and reveal the current information of the market defining what businesses are selling for AND why. This information is based on the sales of hundreds of business during Q1 2018 and some behind the scenes info of the hows and whys-

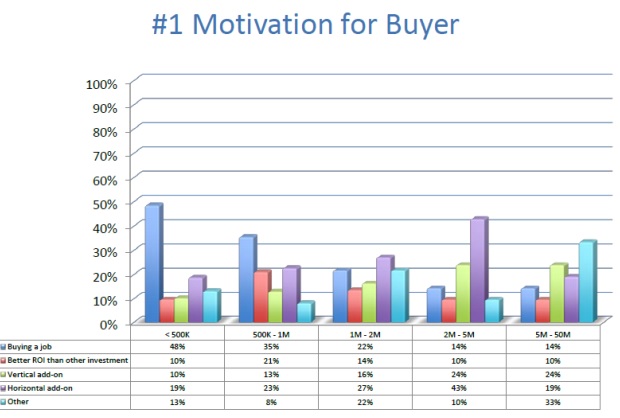

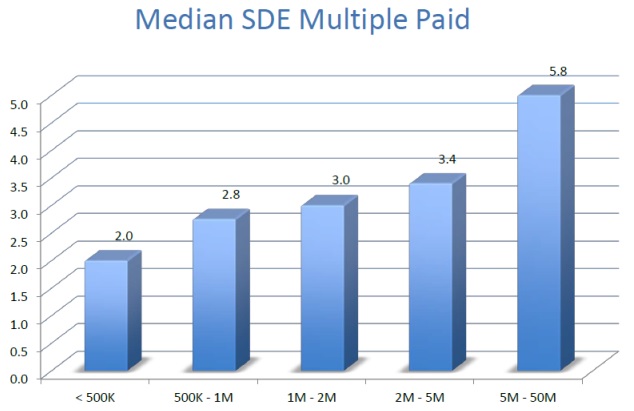

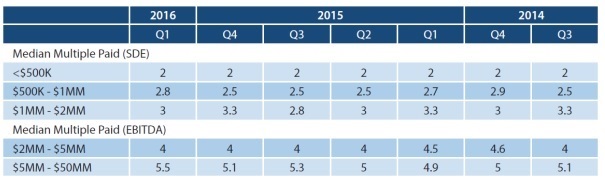

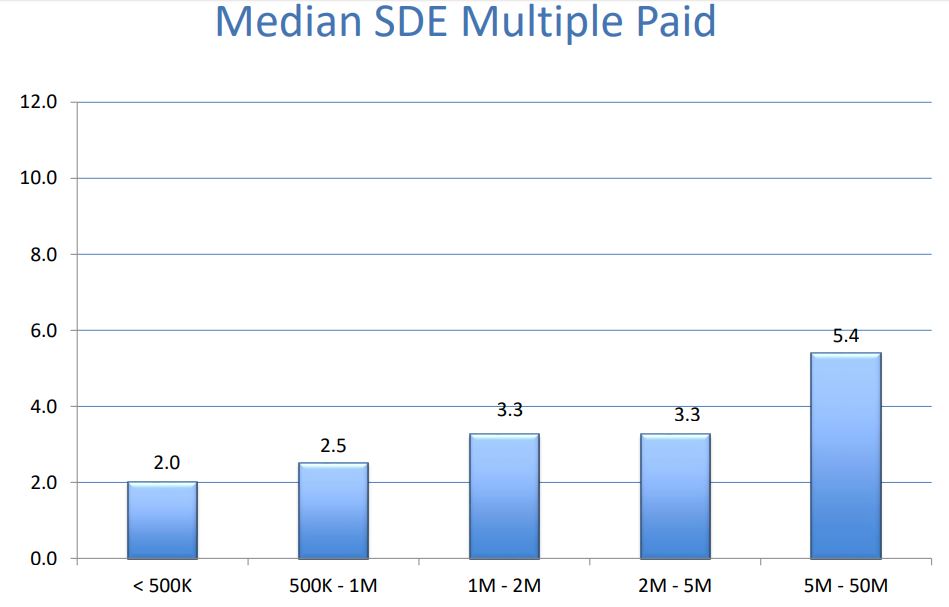

As a Professional Business Broker working with business buyers and sellers in South Carolina and Florida knowledge of the current market is essential. Understanding what businesses are selling for in Anderson South Carolina, Greenville South Carolina and throughout Florida and nationally is essential. Below is current information on the market along with a brief clarification. Possibly the most important note is that How and Why businesses sell vary greatly based on the size of the business. So it always best to view a business that is similar to your size to best use as a comparison and or basis.

SDE equals Sellers Discretionary Earnings which is what a seller earns through wages and benefits along with any Interest, Depreciation and Ammortization that is expense on the company Profit/Loss Statement.

Businesses Selling at Record High

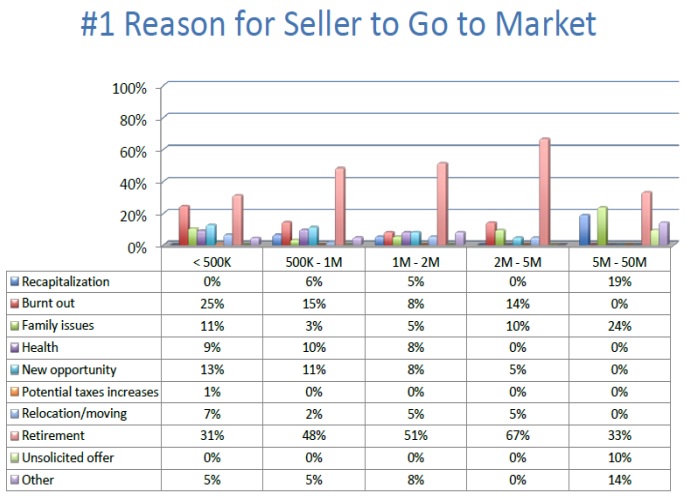

The reason a Seller sells or looks to sell varies greatly and again very often dependent on the business size. BUT also take note of how often a business sells because of “Unsolicited Offers”. Which essentially is someone randomly approaching you to buy your business. Most recent data shows it happens between 0%-3% of the time -NOT OFTEN.

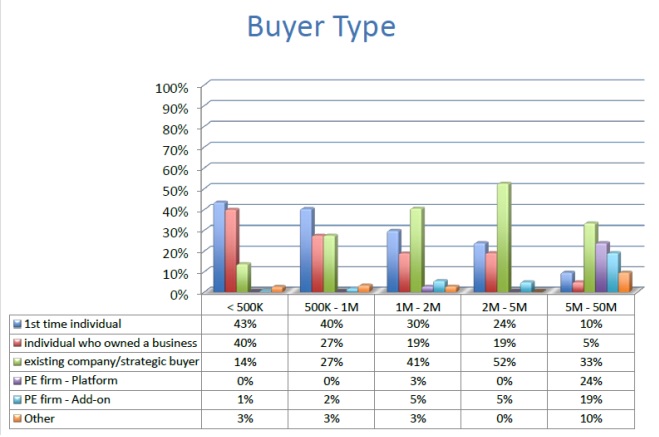

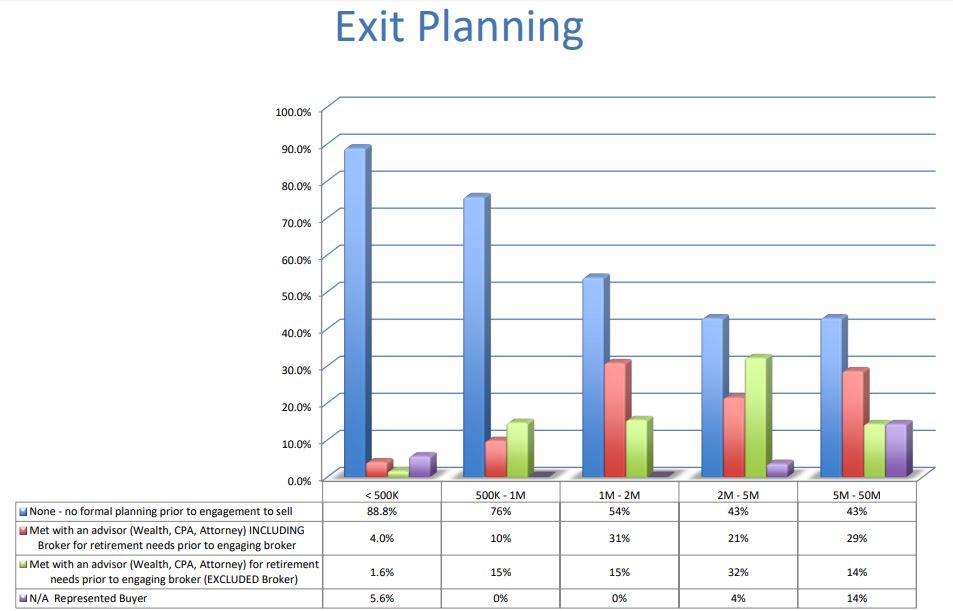

Over 50% of businesses that try to sell and are valued under $500k DO NOT SELL. Businesses valued over $1M sell at a much greater success rate. Planning and preparing helps sell a business. If you own a small printing company in Greenville South Carolina planning for a sale greatly increase the likelihood of a successful sale. If you own a larger business in Anderson South Carolina it is more likely you will plan for a sale and be successful in finding the right buyer. How do you plan to try to sell your business next year ? Start by having a discussion with an experienced trusted advisor this year.

The “Business Selling Market” is doing better than it has in years. Maybe now is the time to consider the sale of your South Carolina business or the sale of your Florida business. The sale of your business is very dependent on business size. Finally, planning for the sale of your business greatly increases the likelihood of a successful sale. For more information on selling a business in Anderson South Carolina, selling a business in Greenville South Carolina, or selling a business in Florida contact me- Scott Messinger at Scott@GatewayBusinessAdvisors.com

Above information Source is a survey I personally have been participating in for several years. Results are compiled and provided by International Business Brokers Association, M&A Source, and Pepperdine University