As a Business Broker based in Anderson South Carolina and work in both South Carolina and Florida, I spend ample amount of time prospecting/marketing for prospective business sellers and prospective business buyers. I work with many qualified buyers looking for a business for sale. I use various marketing methods to market to both buyers and sellers. While in the process of prospecting for business owners considering the exit or sale of their business it is not uncommon to hear “I would be interested in selling my business if I can get the right price”.

Business For Sale – The Right Price

In a past discussion with a business owner- the owner told me he would very much like to sell his business and start a new somewhat unrelated business if the could get the right price for his business. I then asked what he felt may be the right price and he followed up with “I don’t know”.

Business For Sale

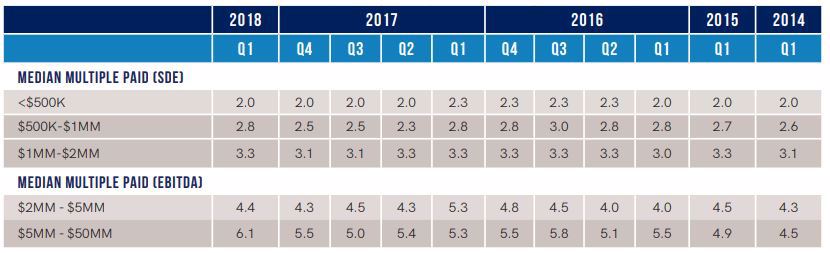

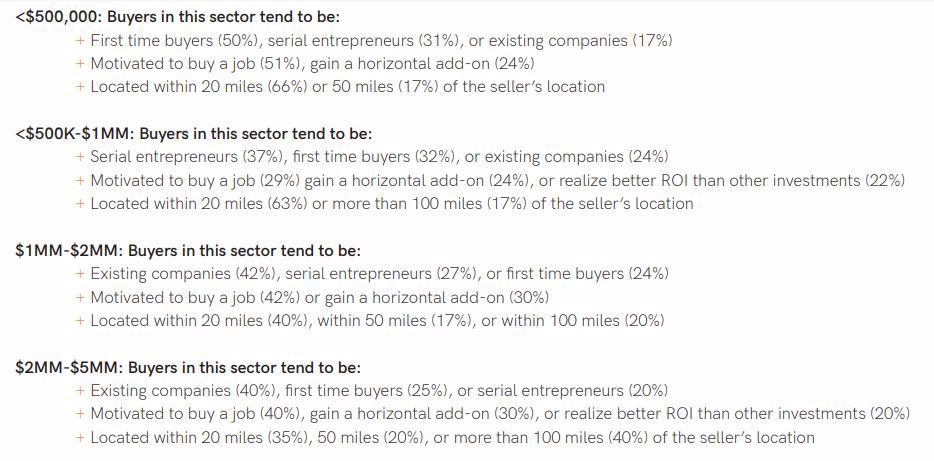

The “right price” may not equal to the business value, or the price a qualified interested buyer is willing to pay. When looking to put a business for sale understanding value may be the best first step.

For an actual transaction to be consummated, the right price needs to resemble actual business value. If the “right price” is actually 2-3 times what estimated value of the business is, it is probably best for all parties involved to spend their time elsewhere.

But is every business for sale? What if a “sweetheart deal” is presented to a small business owner in Anderson South Carolina? If you had a business that is not “For Sale” , and you know it to have an approximate value of $500k and someone walked in and made you a cash offer of $800k cash is your business now for sale to that party?

Is now the time to Sell My Business?

From my personal experience of business ownership, I think yes most businesses are for sale if the “price is right”. But not all businesses. While owning my previous business in the 10th year I had gotten a significant offer for the business, but I had long terms plans and aspirations for the business. At that point in time I had made several acquisitions and made several other offers on other related businesses and was comfortable with valuations, synergy calculations, and felt I knew what the value of my business was.

There was a lot of merger and acquisition activity that was occurring in my industry at that point in time and I was presented with a cash offer from a very strong company, and was at about a 25% premium to what I and my CPA viewed as current value. So I had a very strong cash offer from a well qualified business- do you take the money and move on.?

Business For Sale – The Value

In my opinion business values are affected by both macro and micro economics. What is the state of the economy, what is the state of the merger acqusition economy and what is the state of your industry/your business? These elements effect what sort of multiple of cash flow your business may be worth. If the economy is such that valuations were/are running high do you look to exit your business because valuations, and or those high multiples may not come around again?

In my situation I consulted with my “trusted advisers” around me my CPA, my attorney, my wife. Yet ultimately the decision was mine. My CPA did tell me something that strongly influenced that decision. He had told me “You,ll know when you are ready”. It was a great price great offer, but I wasn’t ready and ultimately sold my business 10 years later and got fair value for the business. So is every business for sale if the “right price” comes along. I think that most businesses are for sale if the right price comes along, but not all businesses. Are you looking to buy a South Carolina Business or looking to Sell a South Carolina Business?

Scott Messinger

(239) 770-2421 (864) 201-8226

Scott@GatewayBusinessAdvisors.com