What is Current Market for Selling a Business (or Buying a Business). I’ve been involved with business sales for approximately 25 years. Fifteen years as a business buyer and Seller during which I acquired 9 businesses and 9 years as a business broker representing business buyers and sellers.

As a business broker working with business Sellers and Buyers in South Carolina and Florida we are afforded access to a lot of market information as it relates to business transactions, what businesses are selling for, and trends. Sales Data and terms on these private transactions are not readily available to the general public.

As a business owner or potential business buyer it is not unusual to “hear about someone that sold his business of $X “. But often that information is incomplete or erroneous.

Below is some market information showing charts and trends relating to business sales throughout the US. I believe it can provide some insights to both potential business sellers in South Carolina or Florida as well as Business Buyers. Also below I’ve highlighted my insights to what I believe some of this information means and what may be worth noting.

A review of over 7000 businesses sold during 2015 show:

- The median asking price grew 12.5 percent from $200,000 in 2014 to $225,000.

- The median sale price also increased a solid 7.6 percent year-over-year, from $185,000 to $199,000.

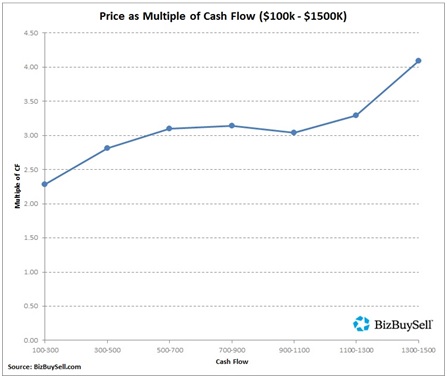

What Does this graph say about Businesses Sold?

A significant determinant of a business sales price is “Multiple of Cash Flow” or “Multiple of SDE (Sellers Discretionary Earnings). But this “Multiple” does vary based on business size ( Sales and Cash Flow). Businesses Sold with Sales of $1M-$5M will generally sell at a different multiple than business sold with Sales of $100k-$1M . Above graph shows as the cash flow of a business increases the multiple of cash flow also increases . This graph shows a business with approx. $150k of cash flow sold for 2.5 x that cash flow (CF). Whereas a business with $1M in cash flow sells for 3.1 times that cash flow (CF).

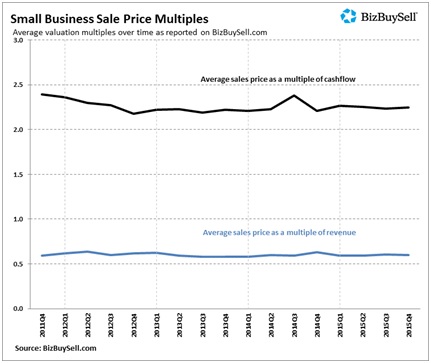

What does above graph say about Business Value and or Business Selling Price. ?

Above Graph depicts that The price of businesses sold ( as a multiple of cash flow ) has remained fairly steady over the last 4 years. Going forward, I expect this to remain consistent thru 2016.

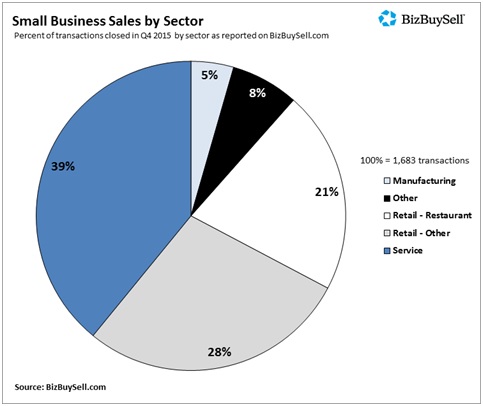

What type of businesses are being sold? Above chart shows the types of businesses sold throughout the US in 4th quarter of 2015.

Are you looking to buy a business in South Carolina or Florida? Are you looking to sell your business. A business is not bought or sold in a vacuum. How does your business measure to other like or similar businesses? No two businesses are the same, but similarities do exist. Understanding value or potential value may be one of the more important steps that goes into the process of buying or selling a business.

Thinking about buying or selling a business? Please feel free to contact me Scott Messinger Business Broker to discuss any questions you may have on the process. And it is a process. Also, feel free to search on businesses for sale on my site at:

www. SellaBusinesssAdvisors.com. or contact me at Scott@GatewayBusinessAdvisors.com

or call direct at (864) 210-8226 or (239) 770-2421.