What Did Businesses Sell For 1st Quarter 2018

|

|||||||||||||||||||||

|

|||||||||||||||||||||

Buying a Business -What is a good Deal?

Buying a Business is not an easy process. Selling a business is not an easy process. Knowing what is a good deal for a business buyer and what is a good deal for the seller greatly assist in achieving the goals of a business buyer or business seller. Understanding what may be the components of a “Good Deal” as a business buyer or a business seller is both important and necessary. I am a business broker and have been involved with business acquisition and sales for over 25 years as broker representing business buyers and business sellers and as a business buyer and business seller of multiples businesses for my own personal gain.

I work with Business Sellers in South Carolina and Florida. I also work with prospective business buyers in Florida, the Upstate, South Carolina, USA and internationally.

There are many components to a successful business purchase and or business sale.

A discussion I always have when working with a prospective business buyer or one looking to sell a business is to make and keep the “Totality of the Deal” a top priority. There are many aspects of a business sale that make up the totality of the deal. It’s easy to just look at Price and go into the process thinking Price is the goal/target of a successful business sale or successful business acquisition. A business sale involves Price, timing, conditions, terms including non-compete, transition, seller post sale involvement, financing, handling accounts receivables, handling payable if applicable, and the list can go on. I define the totality of the deal as how all the components of a business sale meet the goals of a business buyer or business seller. Consider the following scenario –

A business seller may want to sell his/her business for $1M. As a business broker I engage with 2 prospective business Buyers: In this scenario both buyers are willing to make an offer on this $1M Business for sale. Prospective Business Buyer A offers $1M but requires Seller to stay on for 2 years and wants to pay 60% Down and pay balance over 5 years and wants to keep all Accounts Receivables that are on books at time of closing. Also Buyer A demands to know and meet with top 5 major customers before consummating sale. Prospective business Buyer B offers $900k, willing to have Seller stay on as long as Seller wants, has financing setup so Seller gets entire amount at closing, and Seller keeps all Accounts Receivables.

SO what deal is better for the seller? What Buyer believes their offer is most likely to get accepted by the Seller? While a lot of business acquisitions share commonality every business sale is different. What is important to one business buyer may not be important to another business buyer. What is important to a Business seller is ultimately best determined by that business seller. A business selling for $300k may be considered overvalued by some and a business selling for $5M may be considered “cheap” or a good value by others. But setting the goal of trying to achieve a deal that carefully weighs the entire totality of the deal greatly increases the odds of reaching what may be a good deal for you as a business buyer or a business seller.

Scott Messinger is a Professional Business Broker working with business owners looking to sell their South Carolina Business or Florida Business. Also working with business buyers throughout the South east USA, throughout the nation, and international business buyers as well.

Currently represent businesses for sale in Anderson South Carolina, Greenville South Carolina, Pendleton South Carolina, Pickens County, Jacksonville Florida as well as other areas of South Carolina and Florida.

For More information or to discuss how to sell your business for more, email Scott@GatewayBusinessAdvisors.com or call (864) 210-8226

How to sell your business for more. At some point a business owner considers selling their business. Sometimes it is just a fleeting thought. Sometimes its a thought of “I don`t need this anymore, get me out”. Other times its a well planned out progressive process. You want to sell your business- how do you sell it for more. It can just start with a phone call -How to sell my Greenville business?

This sounds like a fairly straight forward approach, but just as the selling of a business process can be very involved, the question of how to sell it for more firstly needs definition. I am a business broker based in Anderson South Carolina, focus on businesses for sale in Florida and South Carolina, and speak to many many business owners about the potential sale of their business. I also sold my own business several years ago.

Just consider the simple analogy of having a rusty bike in the garage with flat tires that you want to sell today. You put it out at the end of the drive way put a For Sale sign on it- what do you think it will sell for? How can you sell that bike for more tomorrow than you can today? How to sell my Greenville business for More?

Selling Your Business For More:

So selling your business for more is a reasonable and understandable goal. How do you get more for your business? Start today preparing your business for sale. Like so many of your other important business decision, prepare yourself a to-do list and systematically address those items. Below are some items you will want to include on your to-do list to help ready your business to sell for more. Ask and honestly answer these questions about your business.

When looking at how to sell my Greenville business for more, ask yourself -How are your financials? Are there some unusual entries on your P/L that have escaped needed adjustment? Are all sales accounted for? Do you have a good clean P/L statement? For smaller businesses Do you have a P/L and Balance sheet?

Again, when looking at how to sell my Greenville business for more, determine, how reliant is your business on you. What can you do today to help your company be more about your company and less about you.?

How documented are your systems, procedures, policies, pricing structure?

Is your customer base as diverse as it should be? How reliant is your business on a few key customers. And again do those customers do business with you the business owner or with the company?

Do you have the opportunity to add recurring revenue streams to your business, but elected to not pursue? Do you have some contracted customers that you just haven’t updated contracts with?

When analyzing how to sell your business fore more, Spend some time to meet with some of your trusted advisers. Dont rely on information you hear through the grapevine about this person selling their business for this amount. Talk to your attorney, your accountant , or visit with a business broker start to really learn the marketplace. Have you scraped the rust off your bike?, painted it ? oiled the chain? pumped up the tires? put an ad in the newspaper? on the Internet?- Is your bike worth more today than it was yesterday?

How to sell my Greenville business for more tomorrow or next year than it is worth today? Start today preparing your business for sale.

Scott Messinger is a Professional Business Broker working with business owners looking to sell their South Carolina Business or Florida Business. Also working with business buyers throughout the South east USA, throughout the nation, and international business buyers as well.

Currently represent businesses for sale in Anderson South Carolina, Greenville South Carolina, Pendleton South Carolina, Pickens County, Jacksonville Florida as well as other areas of South Carolina and Florida.

For More information or to discuss how to sell your business for more, email Scott@GatewayBusinessAdvisors.com or call (864) 210-8226

Selling a Business- It’s about Time

Selling a Business is a process. Many factors go into a successful business sale. I am an experienced Business Broker working with business sellers and business buyers in both South Carolina and Florida.

Below is a description of the role time plays when selling a business. And how one should take the time to plan a business sale and understand if the timing is right when selling a business,

When selling a business, setting the right selling price is important, finding a qualified interested buyer is important, finding the right deal structure is important and in the background of all of this is TIME.

The money involved with selling a business is the engine that that drives the deal forward but inevitably time is the steering wheel that affects where and when the deal goes through.

What affect does time have on the selling a business process?

Is the time right for selling your business? Is the time right for you? Are you ready mentally and financially? As a business owner selling a business- do you have the time?, As a starting point take the time to seek some answers to these questions. You may not have the time but must make the time to properly analyze this very important decision.

Scott Messinger is a Professional Business Broker working with business owners looking to sell their South Carolina Business or Florida Business. Also working with business buyers throughout the South east USA, throughout the nation, and international business buyers as well.

Currently represent businesses for sale in Anderson South Carolina, Greenville South Carolina, Pendleton South Carolina, Pickens County, Jacksonville Florida as well as other areas of South Carolina and Florida.

For More information email Scott@GatewayBusinessAdvisors.com or call (864) 210-8226

Thinking about Selling a Business Or Buying a Business? September 2017 Market Information

As a Business Broker Professional, I participate in Quarterly National Surveys along with over 300 other Business Broker professionals. The below are highlights of the most recent results and represents 293 Business Brokers and Advisors in 38 states and over 250 businesses sold in last 3 months. I focus working with Business Sellers in South Carolina and Florida, and work with buyer prospects througout the USA and international. Below are some highlights of these survey results.

What did these 250 + business sell for from April-June 2017?

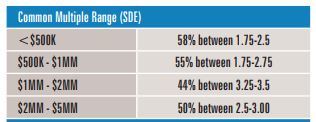

Businesses sell for a “Multiple” of SDE (Seller Discretionary Earnings)- which is similar to Adjusted Cash Flow- essentially what does the business make for an owner and what could it make for a new owner.

Again, the Multiple Paid for a Business is dependent on size (with some variation- some industries do get paid a higher multiple than other industries). The Multiples paid for businesses sold over the last several years have been somewhat consistent with the average multiple paid for a business that is valued under $1M is approximately 2 X SDE.

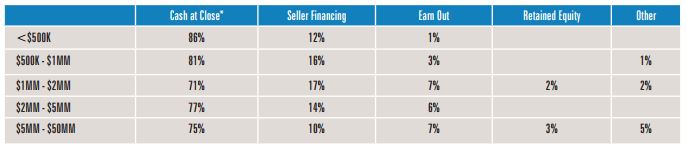

How Much Cash at Closing? –

.

Some Seller financing is typical in business sales of all sizes.Furthermore business buyer rarely walk in with 100% of the Funds needed out of their own pocket. Very often for a business buyer to come up with the 75-86% cash at closing, financing from a bank (often SBA financing) or other financing is secured by buyer to complete the acquisition. For smaller businesses having the business meet the qualifications for an SBA loan can be a challenge and can make a sale difficult or worse.

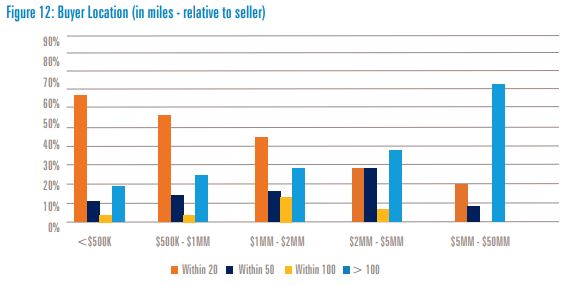

Where Do Business Buyers Come From?

As you can see above, the smaller businesses may find a buyer “down the street”. But the search for a buyer almost ALWAYS requires a search and marketing that includes local, regional, statewide, nationally and often international.

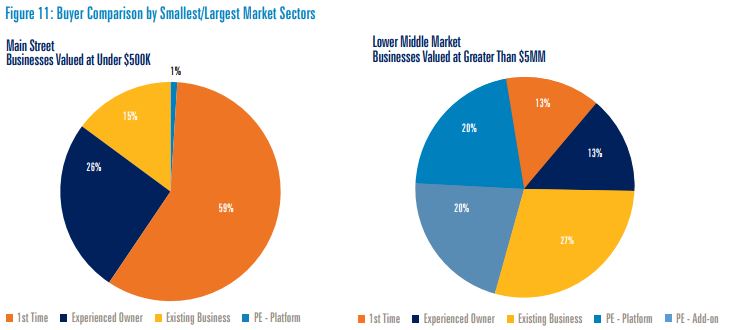

Who Are the Business Buyers?

.

Again, searching for a Business Buyer includes marketing for 1sttime buyers, and experienced business owners for “smaller businesses”. But depending on business size contacting competitors, other strategic buyers, and larger investors are all active applicable business buying prospects.

Thanks to the survey information and IBBA, M&A Sources, Pepperdine Capital Markets Project, and the Graziadio School of Business and Management at Pepperdine University.

For more information please feel free to contact me- Scott Messinger

working with Business Sellers in Greenville South Carolina, Anderson, the entire Upstate and Florida and business buyers throughout the USA and internationally.

I am currently working for business buyers looking for:

:: Salon Greenville SC area

:: Aviation Parts Business S.Carolina

::Business earning $100k+ cash flow in Upstate

::HVAC Business

::Mfg Business w/$400k+ cash flow in Upstate

::Home Service Business

::Pest Control Business

::Multiple Buyers looking for businesses earning $1M+ cash flow

:: Janitorial Business in Florida

Pack and Ship ANderson SC

Businesses that Want to Sell

Business Owners Have recently Expressed Interest in Selling their business: ….

*Window Cleaning

*Auto Parts online and brick/mortar

*Computer Service

*Hair Salon/Spa –

*Metal Refinishing-

*Commercial Contractor

*Electric Contractor

*Sports Bar – SC

*Carpet Cleaning –

*Ethnic Rest.

*Printing Business

Contact me for any

further info on these or more information on selling a business in South Carolina.

September-2017- “Whats Important When Buying or Selling a South Carolina Business

How long does it take to Sell a Business??

I have sold a business in 3 days and one took 3 Years.

I would advise the “average time” to sell a business could be 9-14 months.

If wanting to sell your business next year…. start the process yesterday.

For More info on Selling a Business or Buying a business in SOuth Carolina – Anderson, Greenville, Spartanburg, Clemson, Easly, Greer, Pickens The Upstate and all of South Carolina Florida as well please contact Scott Messinger at:

Scott@Gatewaybusinessadvisors.com

SC- (864) 210-8226

FL (239) 770-2421