Thinking about Selling a Business Or Buying a Business? September 2017 Market Information

As a Business Broker Professional, I participate in Quarterly National Surveys along with over 300 other Business Broker professionals. The below are highlights of the most recent results and represents 293 Business Brokers and Advisors in 38 states and over 250 businesses sold in last 3 months. I focus working with Business Sellers in South Carolina and Florida, and work with buyer prospects througout the USA and international. Below are some highlights of these survey results.

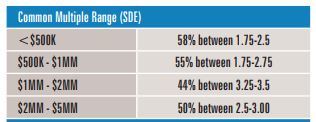

What did these 250 + business sell for from April-June 2017?

Businesses sell for a “Multiple” of SDE (Seller Discretionary Earnings)- which is similar to Adjusted Cash Flow- essentially what does the business make for an owner and what could it make for a new owner.

Again, the Multiple Paid for a Business is dependent on size (with some variation- some industries do get paid a higher multiple than other industries). The Multiples paid for businesses sold over the last several years have been somewhat consistent with the average multiple paid for a business that is valued under $1M is approximately 2 X SDE.

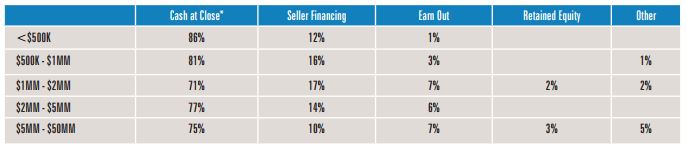

How Much Cash at Closing? –

.

Some Seller financing is typical in business sales of all sizes.Furthermore business buyer rarely walk in with 100% of the Funds needed out of their own pocket. Very often for a business buyer to come up with the 75-86% cash at closing, financing from a bank (often SBA financing) or other financing is secured by buyer to complete the acquisition. For smaller businesses having the business meet the qualifications for an SBA loan can be a challenge and can make a sale difficult or worse.

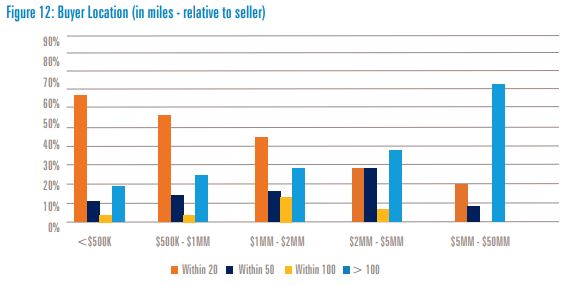

Where Do Business Buyers Come From?

As you can see above, the smaller businesses may find a buyer “down the street”. But the search for a buyer almost ALWAYS requires a search and marketing that includes local, regional, statewide, nationally and often international.

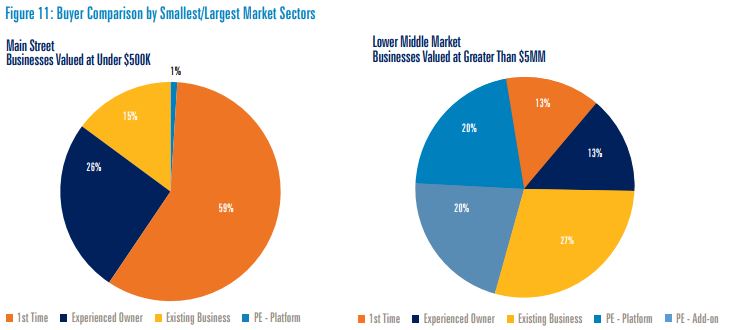

Who Are the Business Buyers?

.

Again, searching for a Business Buyer includes marketing for 1sttime buyers, and experienced business owners for “smaller businesses”. But depending on business size contacting competitors, other strategic buyers, and larger investors are all active applicable business buying prospects.

Thanks to the survey information and IBBA, M&A Sources, Pepperdine Capital Markets Project, and the Graziadio School of Business and Management at Pepperdine University.

For more information please feel free to contact me- Scott Messinger

working with Business Sellers in Greenville South Carolina, Anderson, the entire Upstate and Florida and business buyers throughout the USA and internationally.

I am currently working for business buyers looking for:

:: Salon Greenville SC area

:: Aviation Parts Business S.Carolina

::Business earning $100k+ cash flow in Upstate

::HVAC Business

::Mfg Business w/$400k+ cash flow in Upstate

::Home Service Business

::Pest Control Business

::Multiple Buyers looking for businesses earning $1M+ cash flow

:: Janitorial Business in Florida

Pack and Ship ANderson SC

Businesses that Want to Sell

Business Owners Have recently Expressed Interest in Selling their business: ….

*Window Cleaning

*Auto Parts online and brick/mortar

*Computer Service

*Hair Salon/Spa –

*Metal Refinishing-

*Commercial Contractor

*Electric Contractor

*Sports Bar – SC

*Carpet Cleaning –

*Ethnic Rest.

*Printing Business

Contact me for any

further info on these or more information on selling a business in South Carolina.

September-2017- “Whats Important When Buying or Selling a South Carolina Business

How long does it take to Sell a Business??

I have sold a business in 3 days and one took 3 Years.

I would advise the “average time” to sell a business could be 9-14 months.

If wanting to sell your business next year…. start the process yesterday.

For More info on Selling a Business or Buying a business in SOuth Carolina – Anderson, Greenville, Spartanburg, Clemson, Easly, Greer, Pickens The Upstate and all of South Carolina Florida as well please contact Scott Messinger at:

Scott@Gatewaybusinessadvisors.com

SC- (864) 210-8226

FL (239) 770-2421